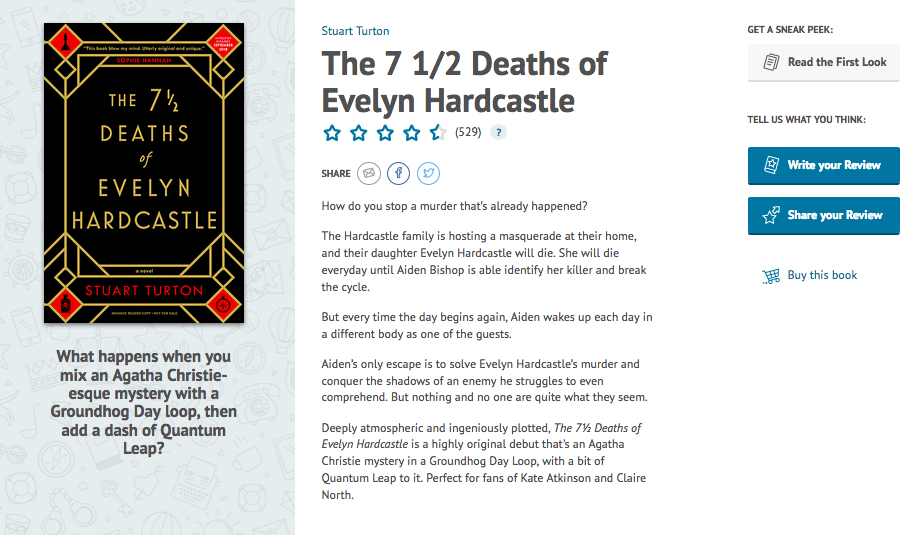

Repackaging books with new covers, new back cover copy, or even a new titles is one of the tools in a publisher’s arsenal to give a book more life. Whether making decisions about the trade paperback design after the hardcover has been on sale, or discussing changes to a backlist title that’s been acquired from another publisher, Sourcebooks uses a lot of data to support their repackaging efforts.

Sarah Cardillo, Director of Publishing Operations at Sourcebooks shares how she and her team use sales numbers, comp titles, and audience responses to guide their redesign strategy.

1. Consider a book’s total positioning, in addition to sales

When we are looking at the trade paper edition of a hardcover release, we start by looking at sales – how many [books] did we actually sell, what percentage of the inventory sold through within the first 6-8 weeks, and did it sell at the level we had expected it to sell? We look at retail sales [as well as] library sales. Sometimes a book might not sell at our expectations at retail, but may have landed very strongly with the library markets.

If we are looking at the cover for a book that was previously published by another publisher, or perhaps self-published, we look at how the book was positioned as a whole. So, we start even further back than the cover. We think about the title, the story hook, or positioning, and the category the book will be shelved in. Even if the book had relatively strong sales, some of these other factors may give us insight into how to launch the book at a new level for Sourcebooks.

2. Involve everyone in the process

Since we start by looking at sales, the decision begins with the sales department and the marketing team. The marketing team weighs in with what they were seeing at the point of launch. Did they get the reviews they’d hoped for, the media placement they’d planned? Do they think the media had an impact on the sales (or lack thereof)? We may also discuss what the consumer reviews look like. Sometimes we see that consumers are most excited about a particular aspect of the book that we did not position against – that we didn’t address on the cover or with the back cover copy.

If this was a previously published book by another publisher or self-published, then the conversation may start with editorial – again though the editorial team starts with how they want to publish the book for their list – once they determine that positioning, the art director will review and make a recommendation on the cover direction.

In most instances, the design team is brought into the conversation when there’s already a recommendation on the table to repackage.

3. Pay attention to comp title performance

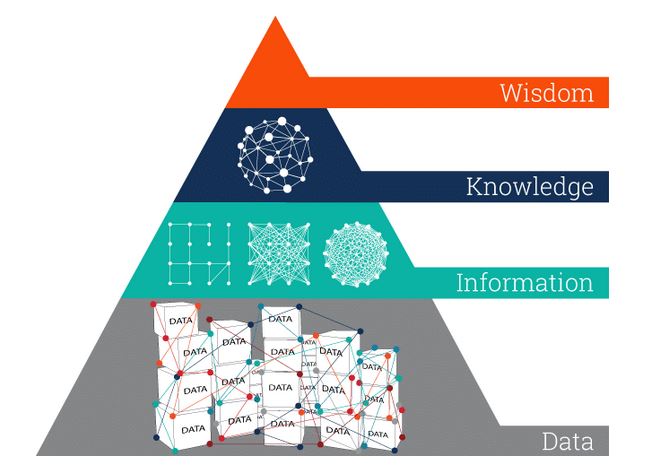

We rely heavily on data – and comp titles provide data. We may see that a design trend has faded or taken off and so we rethink our packaging to fit into that trend. We research the categories and subcategories in depth to provide expertise on what works (and what doesn’t) when positioning a book into a certain category. We want to make sure that the consumer who reads a particular type of book knows at immediate glance that this book is for him or her. We want to make sure that our cover fits within the design space of similar books, but also stands out or stands above the other books. That the consumer sees it and knows it’s what they like to read, and that they care enough to pick it up.

4. Listen to your audience

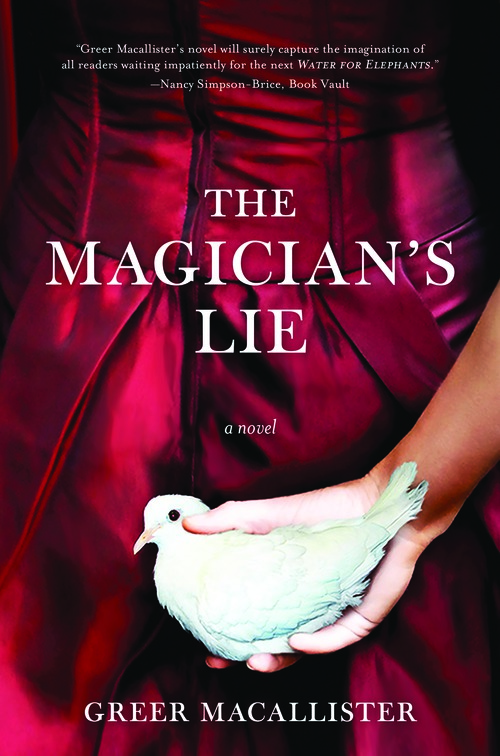

I would say most repackages are driven by external market considerations. If we believe the current cover didn’t help sell the book, a new cover has the chance to reach a different audience – where your hardcover may have been packaged more like a romance, but your reviewers really like the mystery in the story – a repackage could lean toward the mystery aspect. So it’s still based on content, but now external factors are telling us to reposition against other aspects of the content.

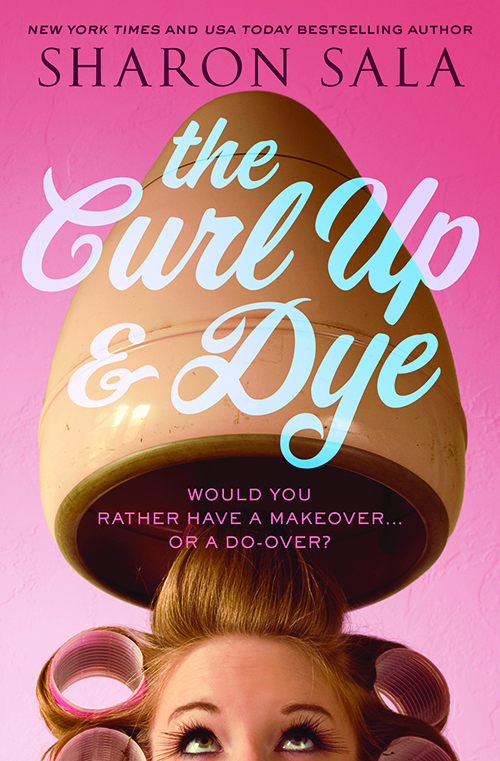

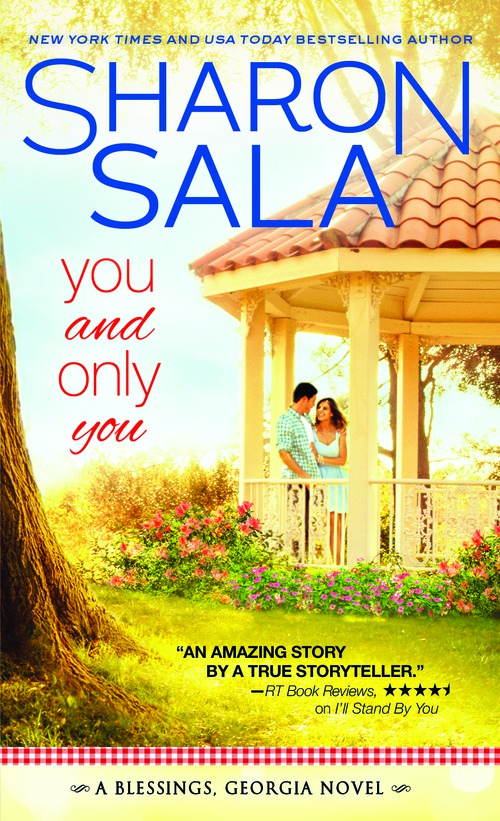

A good example within the romance space was a repackage we did for a book that we published as a trade paperback title – The Curl Up & Dye by Sharon Sala. Sharon Sala is a New York Times bestselling author in the romance space, but this trade paperback did not land the way we had hoped. But when we released her second Blessings, Georgia book, I’ll Stand By You as a mass market romance, we saw that her numbers were very strong in the mass market space and that people really loved her Blessings, Georgia setting. So we then repackaged The Curl Up & Dye as a mass market romance with a new title, You & Only You. It was already set in Blessings, Georgia, but we did not market it that way for the original trade paperback release. When we put it in mass market we made sure to communicate to the consumer via the packaging that this was set in Blessings. The one thing about mass market books and authors is that they often write within a “world” and the consumer is trained to look for copy on the cover (or in online metadata) that indicates a particular book is part of a particular series, or world. The success of I’ll Stand By You showed opportunity and a market – but more specifically that her customers were in that space already – she had success with other publishers in the mass market space, and keeping her where her customers were but then also packaging her new titles in a cheaper format allowed her to grow her reach both with existing customers but also with customers who read similar mass market titles by other authors. Plus, the lower price presented less of a barrier for entry for new customers.

5. Remember your deep backlist

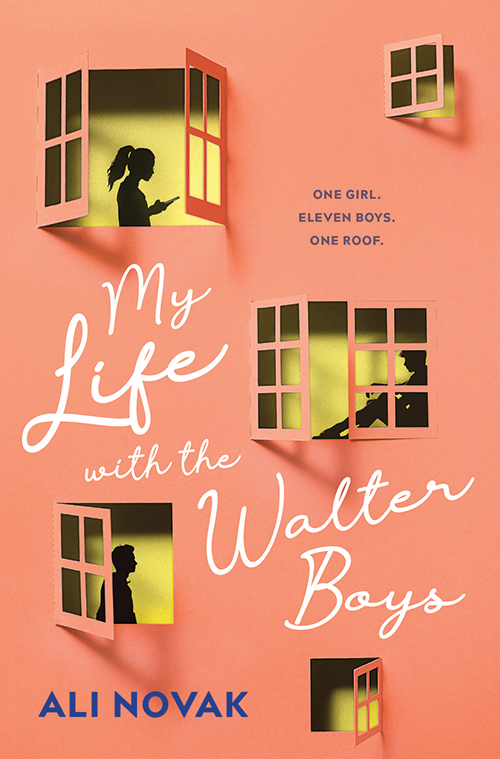

Sometimes we look at titles that were published 5-10 years ago (or more) and think about bringing them back out with new covers as a way to boost sales. Especially in the young adult and the romance space. Since those audiences (especially Young Adult) turn over to new people so regularly and trends change so quickly, a successful book with a fresh cover can easily find new readers, and the accounts are happy to take the book because it was successful in the past with the previous audience. We are seeing a lot of illustrated covers in the young adult space right now. 10 years ago covers were all photographic. So we are looking at our backlist right now and seeing what books sold well but could get new life with an illustrated cover direction.

6. Capitalize on the success of a repackaging campaign

If the sales increase, we can attribute part of that to the cover, of course, but we know other factors may play a part, too. The change to a more affordable format and the repositioning of the back cover copy are also important. When we see a repackage working really well, we’ll consider what we did and if there were elements that we can use from that repackage to guide the cover for the author’s next book or similar books in the same genre.

7. Think about repackaging at all stages of the publishing lifecycle, including acquisitions

Our goal in repackaging the Poisoned Pen Press backlist titles [which Sourcebooks acquired in 2018] was to give them a more cohesive look across authors and series and to have more immediate recognition for consumers. We wanted to make sure that the consumers who devour mystery titles but have never heard of Poisoned Pen would recognize the books as mysteries that they’d want to read. We felt that, while there were many strong covers on the books, there was room to help drive consumer awareness even more. To use our experience designing for this market to increase sales.

Sarah Cardillo is the Director of Publishing Operations at Sourcebooks, one of the 10th largest publishers and the largest woman-owned trade book publisher in North America. She began her career as a production editor with Publications International (now Phoenix International Publications) but since joining Sourcebooks twelve years ago, she has grown her professional reach exponentially. As director of publishing operations, Sarah oversees numerous key departments, including the award-winning art and design department, and the production, manufacturing, and editorial production departments. She utilizes her project management and change management knowledge to build workflows and increase efficiencies across publishing operations. At the onset of the digital transformation, she rebuilt the standard bookmaking process to seamlessly integrate ebook production into the workflow. Her passion for organization and process has transformed the way departments communicate within Sourcebooks. Sarah has both a bachelor’s degree in written communication and a master’s degree in corporate communication and change management.